Support and resistance lines are valuable tools, but they won’t transform your trading on their own. They provide a macro perspective, helping you grasp the bigger picture before zooming into micro-resolutions to make informed trade entries. The precise trade decisions, factoring in timing, price, and micro-fluctuations between buyers and sellers, are best informed by a clear and stable volume flow platform like VolFlow. It’s when all these factors align that you hit the ‘Buy’ or ‘Sell’ button.

Understanding Support and Resistance Lines (S/R Lines)

Once the majority of traders consider a particular line as the decisive one, it effectively becomes just that.

Many traders place significant belief in specific lines, transforming them into critical markers. However, it’s essential to note that most of these markers are based on time-based bar charts.

A Note on Time-Based Bars

- When using time-based bars, it’s typical to focus on the widely watched intervals like 2, 5, 10, 15, 30, 60 minutes, daily, and weekly.

- To better comprehend areas of supply and demand, it’s advisable to shift from macro (e.g., weekly or daily) to micro (2/5/10 minute bars).

- These intervals are popular and familiar to the majority of traders.

What Exactly Are S/R Lines?

- Support and Resistance (S/R) lines are fundamental tools in trading.

- They offer insights into what all traders are observing on a particular instrument.

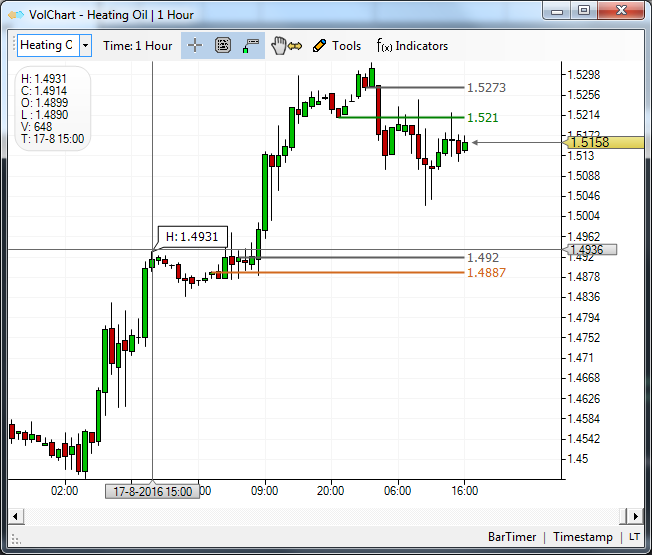

- Understanding what others see on their charts, with variations in color indicating the rank of each line, provides an edge when trading in conjunction with VolFlow’s affirmations – VolBars and VolSign.

When you comprehend supply and demand areas, the remaining step is to execute the trade at precise prices (entry and exit).

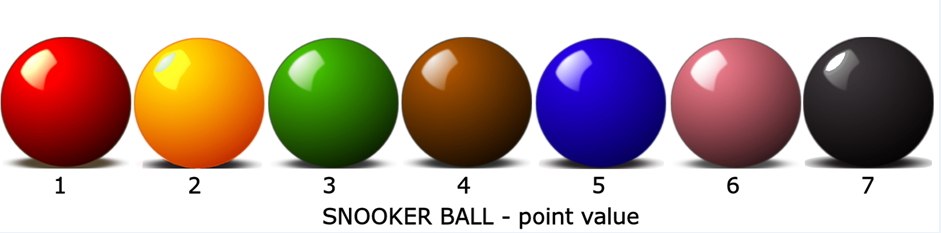

Intuitive Color Coding

Colors play a crucial role, denoting the ranking of S/R lines:

- Red – Tested extensively, highest testing frequency.

- Yellow – Tested less than red but more than green, a moderate testing frequency.

- Green – Tested less than yellow but more than orange, a lower testing frequency.

- Orange – Tested less than green but more than blue, a relatively low testing frequency.

- Blue – Tested less than orange but more than pink, a very low testing frequency.

- Pink – Tested only once, the least testing frequency.

- Grey – Fresh line, not yet tested.

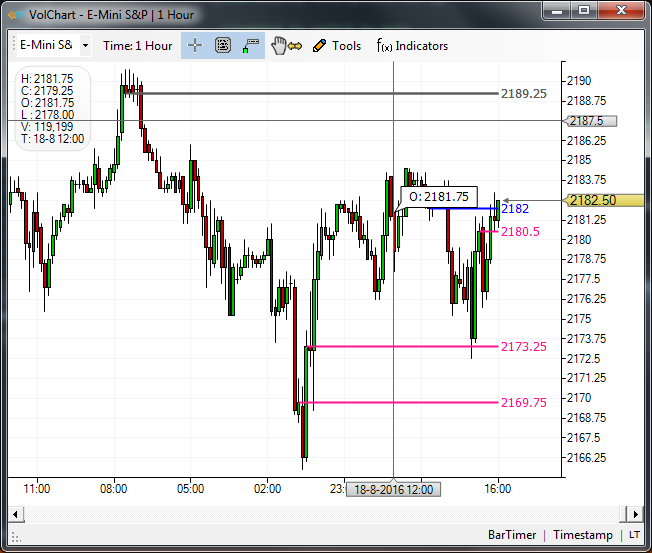

This color hierarchy on VolChart works across all time frame resolutions and updates with every new bar. The number next to each line represents the price, while the number in brackets indicates the number of times the line has been tested.

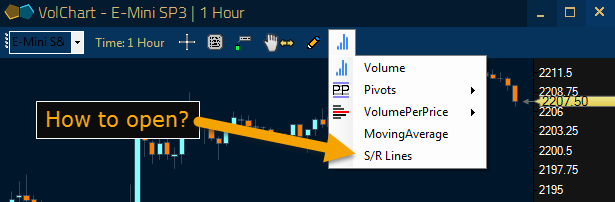

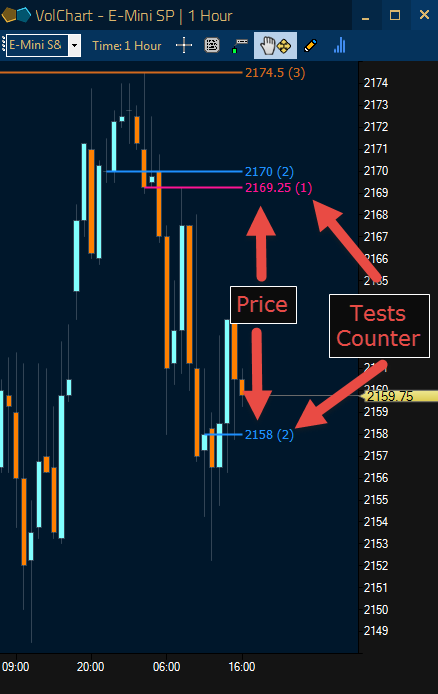

How it appears on VolChart?

- Beside each line, you’ll find its corresponding price.

- The number inside the brackets indicates the testing frequency of the line.

- The format of the text is: “Price (Tests Counter),” for example:

Other examples:

Final Thoughts on the New S/R Lines

We haven’t ‘reinvented the wheel’; we’ve simply streamlined it.

In trading, concepts like ‘Support Lines,’ ‘Resistance Lines,’ ‘Supply Areas,’ and ‘Demand Areas’ are often over-complicated. We believe these are more like self-fulfilling prophecies. We view support and resistance lines as a means to understand the macro aspect of prices and market areas. However, to truly make informed trading decisions, we emphasize the micro – the depth of the market, the actual initiators of buying and selling, and the traders influencing price changes.

Remember, while S/R lines are useful, they are just one part of a larger trading puzzle. To truly master the market, consider the bigger picture and the intricate details within.

Stay updated:

Like Us on Facebook http://facebook.com/VolFlow

Follow Us on Twitter http://twitter.com/VolFlow

Find Us on Skype, Search for “VOLFORT.com”.

Visit Us at VOLFORT.com

Under no circumstances shall VOLFORT be liable for any loss or damage you incurs as a result of any trading or investment based on any information or material receiving through our EMAILS, WEBSITES, SOFTWARES, OR ANY OTHER PRODUCTS OR SERVICES. Past performance is no guarantee of future results and the risk of loss in trading can be substantial. VOLFORT its managers, employees, shareholders and/or anyone on behalf VOLFORT are NOT registered advisors by any state law and never presented themselves as such. THIS BRIEF STATEMENT CANNOT DISCLOSE ALL THE RISKS AND OTHER SIGNIFICANT ASPECTS OF TRADING THE MARKETS, YOU SHOULD THEREFORE CAREFULLY STUDY THIS TERMS AND CONDITIONS AND COMMODITY FUTURES, OPTIONS, STOCKS, FOREX, OR ANY OTHER FINANCIAL INSTRUMENT BEFORE YOU TRADE AS WELL AS CONSULT YOUR OWN REGISTERED INVESTMENT ADVISOR OR BROKER BEFORE INITIATING ANY TRADE.